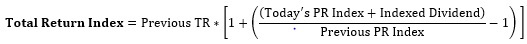

Methodology for Total Returns Index (TR) is as follows:

The following information is a prerequisite for calculation of TR Index:

- Price Index close

- Price Index returns

- Dividend payouts in Rupees

- Index Base capitalisation on ex-dividend date

Dividend payouts as they occur are indexed on ex-date.

Indexed dividends are then reinvested in the index to give TR Index.

Base for both the Price index close and TR index close will be the same.

An investor in index stocks should benchmark his investments against the Total Returns index instead of the price index to determine the actual returns vis-à-vis the index.